Keisha Peters

is here to help you!

I negotiate with 65+ lenders to find the best mortgage rates in Ontario made just for you.

Consolidate and Save

With a debt consolidation mortgage

Is this for me?

You are a homeowner, have equity in your home, and have one or more high-interest debt balances.

What is it for?

To use equity in your home to pay off high-interest debt and consolidate them with your mortgage into one monthly payment to save thousands.

There’s good debt and bad debt

Think of good debt as the kind of debt that’s secured against a property. For example, your mortgage or a home equity line of credit (HELOC). These are considered “good” loans because they are secured against your property and therefore have lower interest rates – in fact, historically low at the moment!

Think of bad debt as the money you have owing on credit cards and personal lines of credit. This is a bad form of debt because interest rates on these types of loans are far higher since they are unsecured (in other words, not secured by a piece of property).

How to consolidate through our debt consolidation services

Debt consolidation is when you take out one loan to pay out many others. Think of all your current debts as boxes. A debt consolidation involves your purchase of one brand new bigger box that you can then fit all your other debts inside of.

Here’s an example:

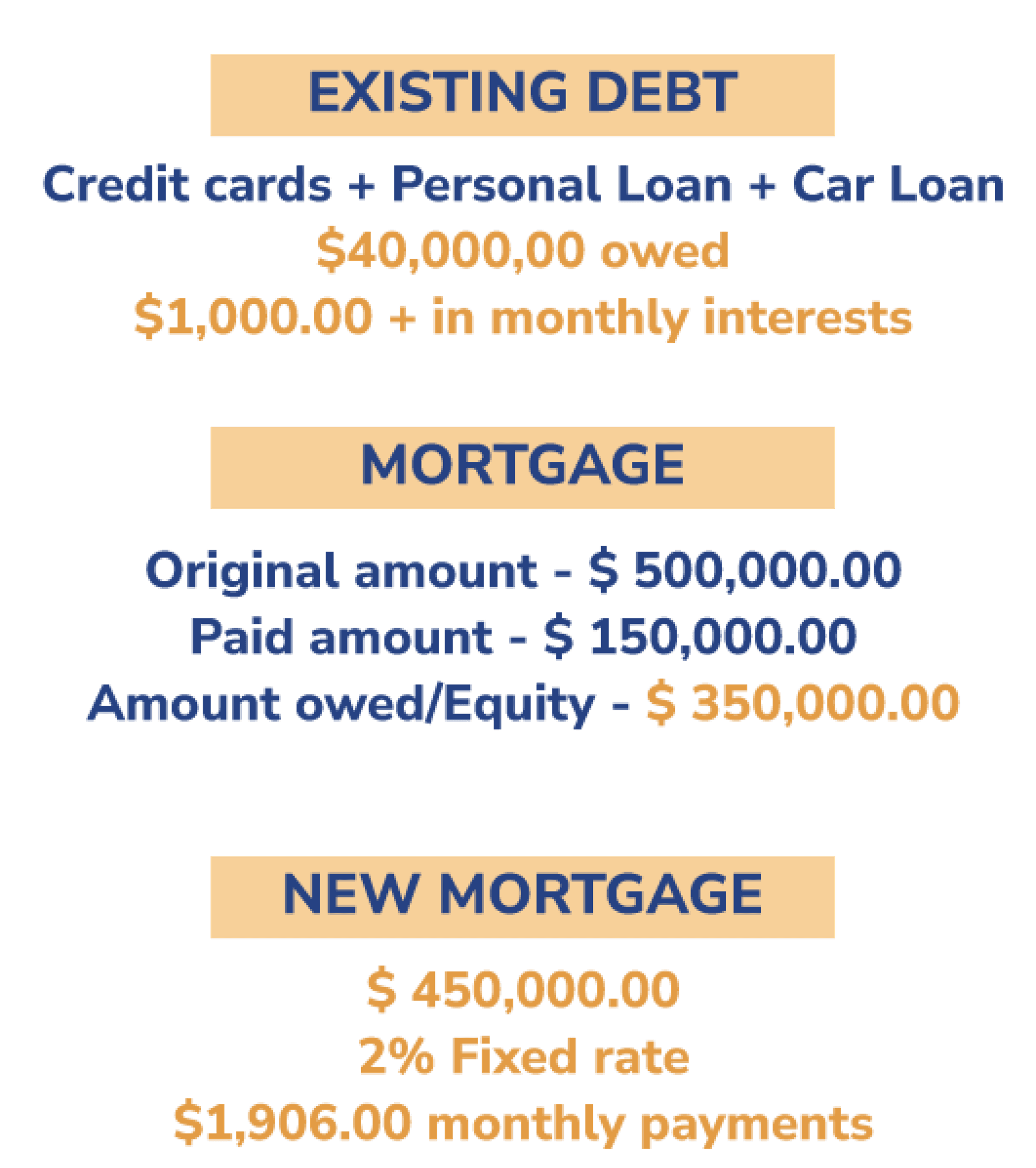

Debbie is carrying $40,000 in various forms of debt – a personal loan, credit cards and a car loan. The interest rates on these loans are all quite high, so she’s paying over $1,000 a month in interest alone, but not really making much progress on paying off the principal balances.

Debbie also owns a house that she bought for $500,000 5 years ago with a 30-year fixed-rate mortgage, and the property is now worth $700,000. At the time of purchase, she put 20% down and currently owes $350,000 on it. Therefore, the total equity in her home is $350,000. This is more than enough money to pay off her debt.

If Debbie takes out a new mortgage even for as much as $450,000 (which will easily cover the closing costs of her refinance), this will more than pay off her debts, and at a fixed rate of 2.0%, her monthly payments will be $1906.00.

Before her refinance and debt consolidation she was paying more than half of this amount towards interest alone!

Need help with a debt consolidation loan?

If you still have questions, feel free to call us and one of our debt consolidation experts will give you the answers you’re looking for. We’re more than happy to walk you through the process so you feel comfortable and ready to make a smart financial decision.